Wynn Resorts Leans on Premium Play in Q4 and Full Year 2025 Revenue Report

Wynn Resorts, Limited has released its financial results for the fourth quarter and full year ended December 31, 2025, revealing a mixed financial picture marked by resilient premium gambling activity offsetting declines in broader consumer demand.

Key Takeaways:

- Wynn Resorts reports slight revenue growth driven by premium gambling

- Declines in rooms and food-and-beverage segments reflect industry volatility

- Company explores strategies to boost group business and revitalize offerings in 2026

Fourth quarter revenue growth amid tourism decline

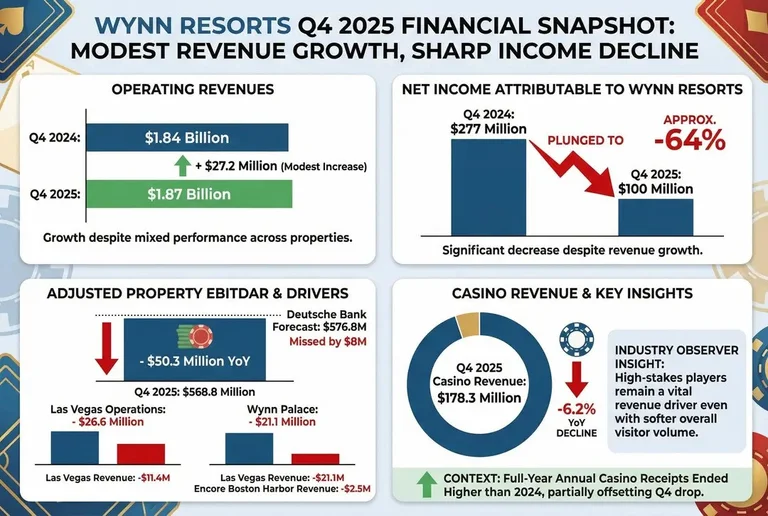

Wynn Resorts reported operating revenues of $1.87 billion for the fourth quarter of 2025, representing a modest increase of $27.2 million compared to $1.84 billion during the same period in 2024.

Despite the increase in operating revenues, net income attributable to Wynn Resorts plunged to $100 million in Q4 2025 from $277 million in Q4 2024. Industry observers highlight that the casino floor’s high-stakes players continue to generate substantial revenue even when overall visitor volume softens.

Adjusted Property EBITDAR also dropped by $50.3 million year-over-year to $568.8 million, $8m below Deutsche Bank analyst forecast.

The decreases attributed largely to the Las Vegas operations ($26.6 million) and Wynn Palace ($21.1 million). The company’s Las Vegas operations and Encore Boston Harbor experienced revenue declines of $11.4 million and $2.5 million, respectively, underscoring localized softness.

“Our fourth quarter results reflect continued strength throughout the business,” said CEO of Wynn Resorts Limited, Craig Billings. “The team in Las Vegas delivered another quarter of healthy EBITDA.”

The results also come amid executive changes at the company. Wynn Resorts recently confirmed the appointment of a new chief financial officer, a move seen as reinforcing financial oversight during a period of operational recalibration.

Casino revenue falls but future looks steady

Casino revenue, a core business segment for Wynn Resorts, declined 6.2% year-over-year in Q4 2025 to $178.3 million. The drop was partially offset by full-year growth, as annual casino receipts ended higher than in 2024.

Industry observers highlight that the casino floor’s high-stakes players continue to generate substantial revenue even when overall visitor volume softens.

With operating revenues for the full year 2025 inching up slightly to $7.14 billion , an improvement of $10 million from the previous year, the company’s mixed results underscore both resilience and challenges in different operational areas.

Wynn are expecting impact from the World Cup later this year despite the remodel of the Encore tower beginning in May, according to the Wynn call.

“Overall, our 2026 estimates are down modestly, while our forecasts for 2027 are up slightly.” said analysts at Deutsche Bank. Macau’s growing market and continued business from high-end customers at Las Vegas is attributed.