UBS Upgrades Macau 2026 GGR Forecast Amid Premium Demand Boost

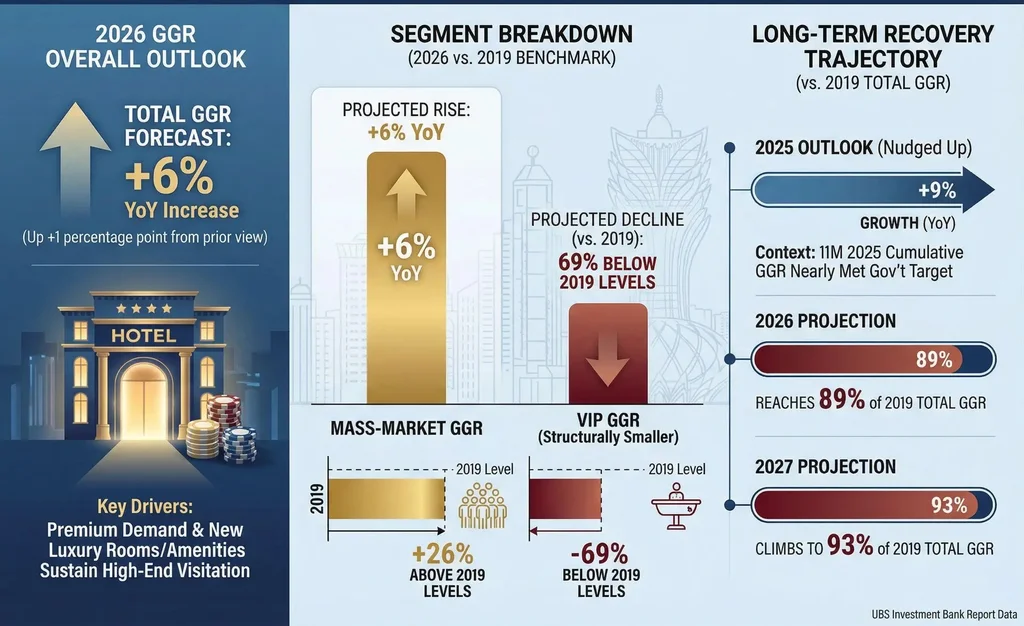

Investment bank UBS raised its Macau 2026 gross gaming revenue forecast to a 6% year‑on‑year increase, up one percentage point from its prior view, saying premium demand and new luxury rooms and amenities will sustain high‑end visitation.

Key Takeaways

- UBS raises Macau 2026 GGR growth forecast to 6%

- Premium demand and new luxury offerings support high-end visitation

- Market optimism points to further recovery and strategic focus on premium amenities

According to Asia Gaming Brief, mass‑market GGR is also set to rise 6% to 26% above 2019 levels, while the VIP customer segment revenue remains structurally smaller, projected to be 69% below 2019.

The bank expects total GGR to reach 89% of 2019 in 2026 and 93% in 2027. It nudged its 2025 outlook to 9% growth as premium demand continues to outperform initial expectations, despite Golden Week setbacks, with cumulative GGR for the first 11 months of 2025 nearly meeting the government target.

Premium Demand Lifts Forecasts and Operator Outlook

UBS attributes the upgrade to improving reinvestment trends, a broader visitor mix and upcoming premium supply, with new suites at MGM Cotai and Wynn Tower and Melco’s Countdown Hotel that should favor premium‑focused operators.

Other brokers offer mixed assessments, with Morgan Stanley and Jefferies highlighting differing recovery speeds and operator positioning, underscoring how demand trends continue to vary based on footprint, hotel capacity and premium exposure, as reported by Yogonet.

Brokers Split as Reinvestment and New Supply Reshape Trends

UBS adjusted company‑level forecasts accordingly, keeping a “buy” on Wynn while lifting Sands’ revenue outlook and trimming MGM’s EBITDA on cost pressures. It noted premium‑positioned operators are likely to capture share as upgraded suites and elevated service roll out.

Industry data and broker notes suggest executives should prioritize premium amenities and targeted loyalty incentives to capture rising premium demand and capitalize on the premium demand environment, as reported by Asia Gaming Brief.