Studio City Trims 2025 Loss on Mass-Market Growth in Macau

Studio City International reduced losses and grew revenue in 2025 as its mass-market gaming and non-gaming operations in Macau strengthened, the company reported in its unaudited results for the year ended December 31, 2025.

Key Takeaways:

- Revenue increased to US$694.6 million in 2025

- Losses reduced as operational adjustments paid off

- Company highlights growth in non-gaming and mass-market operations

Gaming revenue climbs as losses narrow

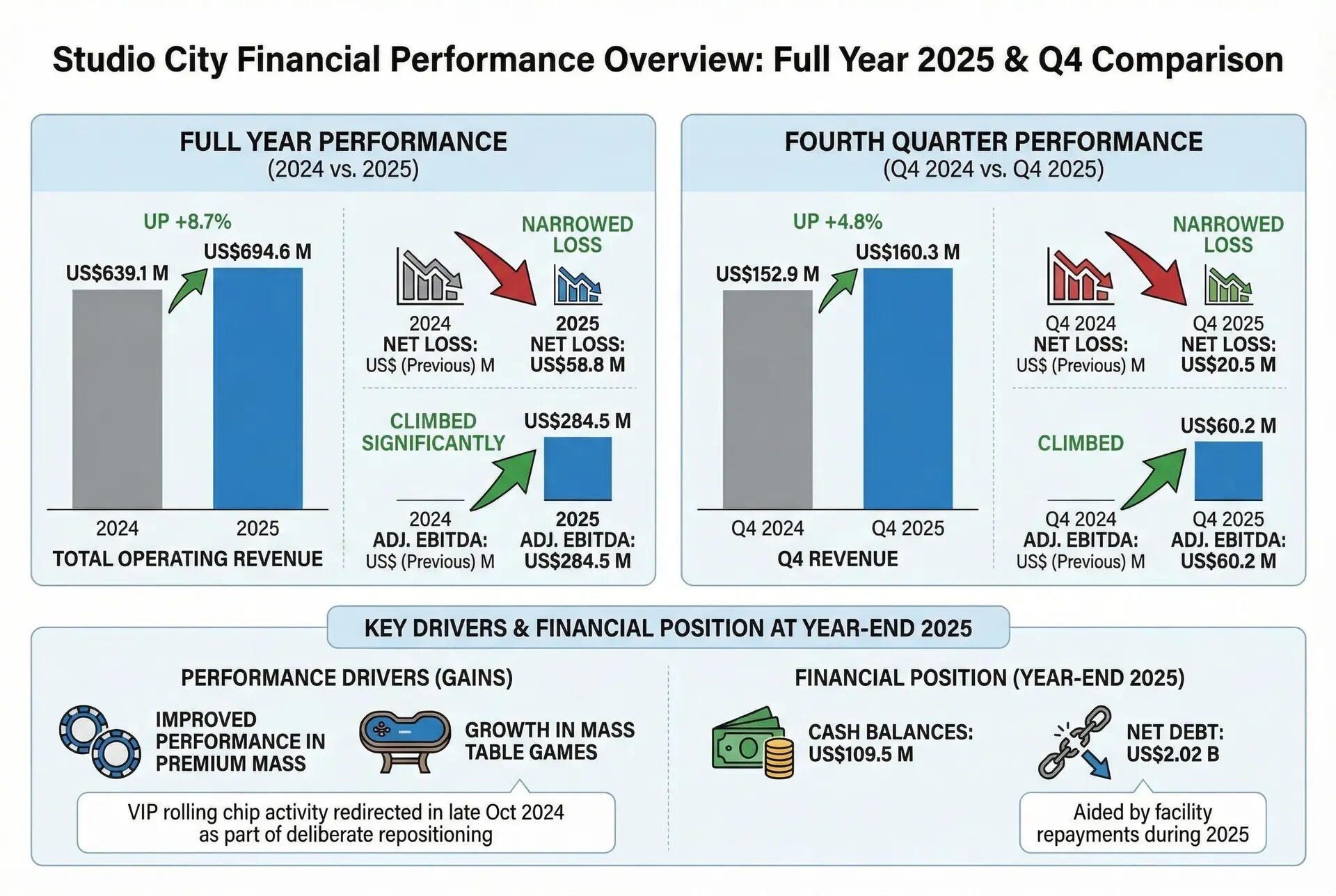

Studio City International Holdings reported that total operating revenue rose to US$694.6 million from US$639.1 million a year earlier, while fourth-quarter revenue reached US$160.3 million versus US$152.9 million in Q4 2024. Net loss attributable to the company narrowed to US$58.8 million for 2025 and to US$20.5 million in Q4.

Studio City credited improved performance in premium mass and mass table games for the gains and said VIP rolling chip activity had been redirected to City of Dreams in late October 2024, part of a deliberate repositioning.

The improvement comes amid a broader recovery in Macau’s gaming market.

Recent reporting has highlighted stronger-than-expected gross gaming revenue in 2025, while operators such as MGM Resorts have flagged improving Macau revenue trends in early financial disclosures. The sector-wide rebound in mass-market play has provided tailwinds for properties repositioning away from VIP reliance.

Balance sheet strengthens as mass-market strategy gains traction

Adjusted EBITDA climbed to US$284.5 million for the year and to US$60.2 million in Q4, according to the press release, “Adjusted EBITDA” excludes interest, taxes, depreciation and certain intercompany and concession costs, which helps explain differences with figures published by its majority owner.

The company also reported higher non-gaming revenue and a modest rise in casino contract income.

Cash balances stood at US$109.5 million at year-end and net debt fell to US$2.02 billion, aided by facility repayments during 2025.

Depreciation, interest and other non-operating expenses weighed on the bottom line, and the company reiterated forward-looking risks tied to Macau market conditions and regulatory change in its safe-harbor statement.