MGM Resorts’ Early Financial Release Highlights Macau Revenue Growth

MGM Resorts acknowledged an inadvertent early posting of preliminary fourth-quarter and full-year financials tied to its BetMGM release, revealing strong results at its Macau arm and across the group ahead of the scheduled investor statement.

Key Takeaways:

- Early leak of preliminary Q4 and full-year results sparks governance questions

- MGM China shows significant revenue and EBITDAR gains, driving group growth

- Market reacts to disclosure amid signs of regional operational strength and high hold effects

Revenue Strength Underscored by Macau Market Momentum

According to GGR Asia, the unaudited figures shown publicly indicate MGM China revenue rising to about US$1.24 billion and adjusted EBITDAR near US$332.3 million, while consolidated revenues and net income also expanded sharply.

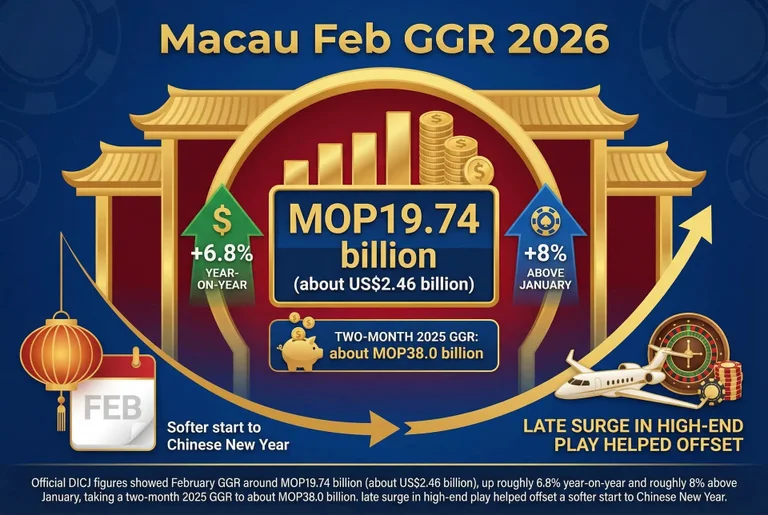

The strong preliminary results at MGM China align with broader momentum in the Macau market. Macau’s gross gaming revenue for January 2026 hit MOP22.63 billion — the highest for the month since 2019 — underscoring a post-pandemic rebound that is lifting operator performance across the region.

The company said in a filing: “This preliminary financial information has not been audited or reviewed by the company’s independent registered public accounting firm” and “shall not be deemed ‘filed’ for purposes of Section 18 of the Securities Act of 1934,” reported Inside Asian Gaming.

Revenue Cushions Market Reaction

Analysts noted the stock reacted to the disclosure, underscoring investor sensitivity to Macau and regional performance after MGM’s record consolidated revenues in 2024.

Industry data shows MGM China delivered strong year-over-year EBITDAR gains in recent reporting cycles, and BetMGM’s accelerating revenue trajectory has been highlighted by the company as moving toward profitability.

The early posting raises governance and disclosure questions even as operational momentum appears intact across the group.