Macau’s High-Roller Betting Reshapes Gaming as Margin Pressure Builds

Macau’s casino scene is witnessing a striking surge in high-roller betting among “whales,” affluent gamblers who place exceptionally large wagers.

Key Takeaways:

- Macau sees a 72.3% increase in whale betting volume in January, with notable high-roller betting reaching HKD1 million

- Premium mass segment also grows, driven by fewer but larger bets, despite a slight decline in player numbers

- Analysts warn that rising VIP play and higher operating costs may pressure profit margins despite revenue growth

A recent January survey by Citigroup reveals a 72.3% year-over-year increase in total bet volume from these players, with 28 whales identified across major casinos, up from 24 a year prior, per Macau Daily Times.

Total wagers reached HKD8.1 million, nearly doubling the HKD4.7 million recorded in January 2025, while average wagers per whale jumped 49% to HKD290,000.

Notable single bets included HKD1 million at Galaxy Entertainment Group’s Horizon Room, HKD850,000 at Melco Resorts’ City of Dreams, and HKD640,000 at Wynn Palace’s Chairman’s Club.

Citi analysts George Choi and Timothy Chau attribute this boom to Macau’s growing appeal to affluent mainland Chinese consumers, supported by promotional efforts linked to high-profile concerts and events, confirming the city’s ability to attract wealthy clientele with both gaming and non-gaming offerings.

High-Roller Betting Accelerates as Whales Drive Larger Wagers

Alongside whale betting, Macau’s premium mass segment has also expanded significantly. Premium mass wagers rose 25% year-over-year to HKD16 million across 564 players, though the player count dipped by 11%.

Average bets within this segment grew 41% to HKD28,424, matching peak levels seen during the 2025 Golden Week holiday.

Market share leaders for January included Galaxy at 25%, followed closely by Melco, Wynn and Sands China, each controlling about 20%.

Rising VIP Mix Puts Profit Margins Under Pressure

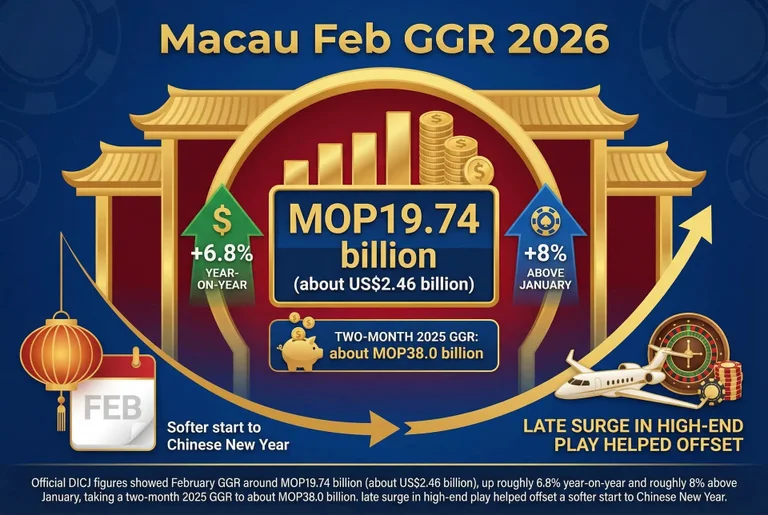

While gross gaming revenue growth appears robust, rising 9% in 2025 and exceeding earlier estimates, JP Morgan analysts have sounded caution about the sustainability of profit margins.

The investment bank lowered its 2026 EBITDA forecasts for Macau’s top six casino operators by 3% to 4%, citing a less favorable revenue mix driven by an increasing proportion of VIP baccarat play.

This segment now accounts for 16% of total GGR, up from 12% in 2024, but it yields lower margins than mass-market play.

Additionally, operating expenses have risen at an accelerated pace of about 7% annually, outstripping typical inflation rates largely due to non-gaming expenditures such as concerts and private events.

JP Morgan analysts Selina Li, D.S. Kim and Lindsey Qian noted that “events lifted GGR but also weighed on margins given weaker flow-through,” underscoring a tougher operating environment despite revenue gains reported by IAG.

This profit pressure has led to downgrades for operators SJM Holdings and Melco Resorts, reflecting concerns about a fading margin upcycle and limited operating leverage amid ongoing reinvestments.