Macau Gambling Revenue Shows Resilience Despite Early February Slowdown

Macau’s gaming revenue eased in early February but seasonal patterns and a strong 2025 base suggest resilience.

Key Takeaways

- Early February GGR dipping 14% from January but still ahead of last year

- Recovery driven by premium mass play after junket exit, supporting overall growth

- Analysts maintain optimistic outlook with above pre-pandemic levels expected in 2026

Early February Gaming Revenue Softens After January Surge

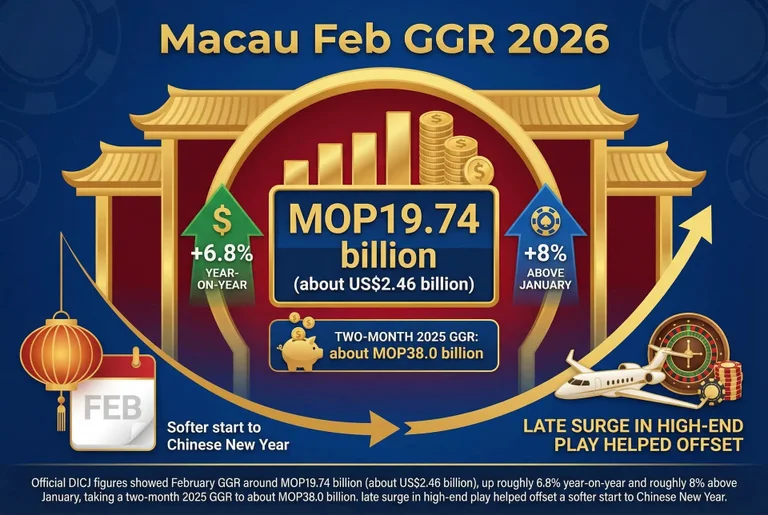

Gross gaming revenue for the first eight days of February reached roughly MOP5.0 billion, implying a daily run-rate about 14% below January’s pace, yet still supporting an above‑year‑ago outcome for the two months combined, per Inside Asian Gaming.

GGR rose to MOP247.4 billion in 2025, underpinning a recovery driven by premium mass play after the junket exit, which helps explain why softer short‑term flows have not dented broader momentum.

Premium Mass Play Underpins Macau’s Post-Junket Recovery

Citi noted the slowdown reflects a customary pre‑Chinese New Year lull and reported VIP volumes down 12–14 percent month‑on‑month while mass GGR fell about 11–13 percent, adding that “VIP hold rate appears to be largely normal,” as reported to GGR Asia.

Past Citi analysis has documented similar weekly swings as visitation and high‑roller movement fluctuated through 2025, emphasizing the market’s sensitivity to holiday timing and mainland travel windows.

Looking ahead, Citi keeps a February GGR forecast of MOP20.5 billion and a combined January–February estimate implying 13.5 percent year‑on‑year growth.

Government and industry figures showing robust late 2025 performance provide context for a market now settling into a post‑junket, premium‑led structure.