Gaming Pulse Report

A November analysis from Optimove examined key performance indicators in the online gaming sector, comparing U.S. and global markets. The data was based on a 12-month (November 2024-November 2025) average of 3.2 million active players in the U.S. and 21 million globally.

• Global Growth Versus U.S. Contraction: The study reported a stark contrast in U.S. and global trajectories. The U.S. contracted significantly, ending November 2025 with casino bettors at 86 percent and sports bettors at 88 percent, down from the 100 percent baseline a year earlier. Conversely, the global market achieved positive year-over-year growth. Active casino bettors rose to 108 percent and sports bettors to

103 percent.

• Funding vs. Action: While average deposit amounts increased significantly, actual wagering contracted. Both sports and casino betting amounts fell in November, suggesting that while U.S. players added more funds in late 2025, they hesitated to bet immediately.

• Global “October Peak” and November Correction: Globally, October 2025 was a peak activity month that corrected in November. This indicates a seasonal adjustment after the start of the sports season.

• Retention Volatility: U.S. retention rates swung from 75 percent in September to a low of 60 percent in October, then rebounded to 69 percent in November. By contrast, starting the previous February, global retention remained almost flat, demonstrating superior habit formation.

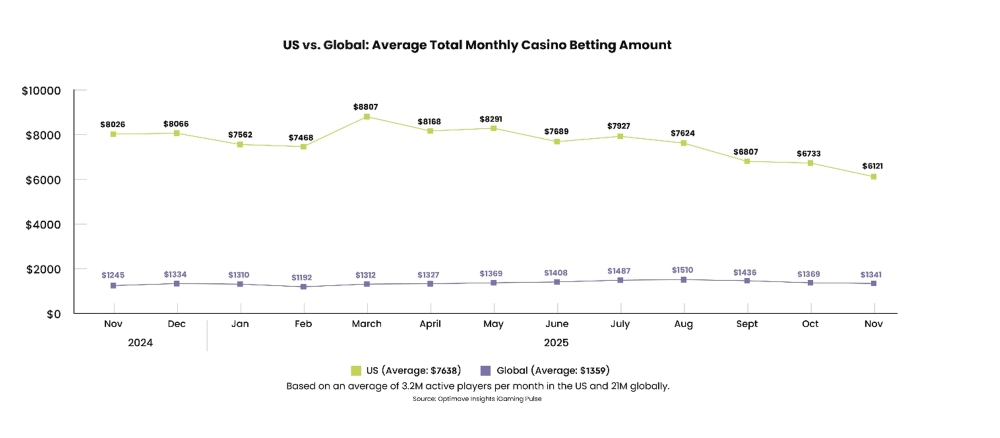

U.S. vs. Global: Average Monthly Casino Betting Amount

U.S. players wagered astronomical amounts compared to global players. Averages consistently ranged between $6,121 and $8,807, while the global average sat firmly at $1,359. This indicates that while the U.S. may have fewer activity days, the intensity of play is far higher.

In previous months, the U.S. market took a significant hit. The average bet amount dropped from $6,733 in October 2025 to $6,121 in November 2025, the lowest point in the entire 12-month period. The global market also saw a slight decrease, moving from $1,369 in October to $1,341 in November, but it remained far more stable relative to its annual average.

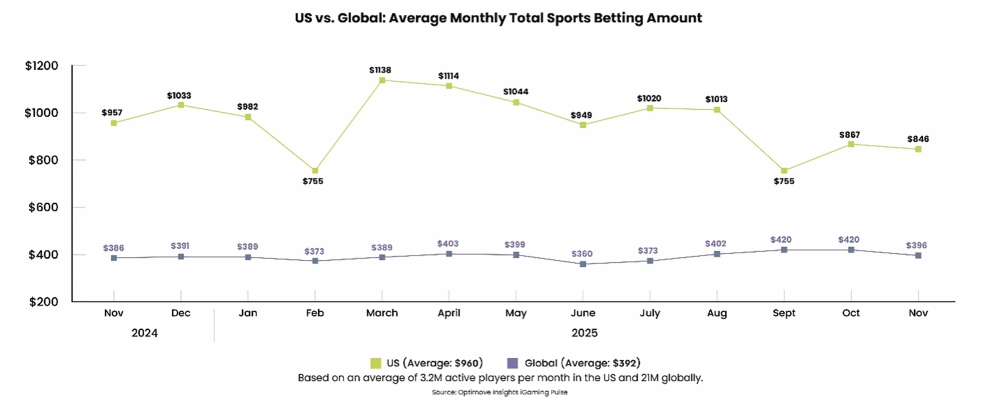

U.S. vs. Global: Average Monthly Total Sports Betting Amount

The U.S. market is defined by high volume and high seasonality. The global line is much flatter, showing a slow but steady consistency. Despite the U.S. volatility, the average U.S. sports bettor wagers significantly more, often double or triple the amount of the global average player.

In the most recent comparison, both markets declined. The U.S. average fell from $867 in October 2025 to $846 in November 2025, a cooling trend from the seasonal peaks. Similarly, the global average dropped from a peak of $420 in October to $396 in November 2025, suggesting a widespread seasonal dip in sports wagering intensity during this month.