Detroit Gaming Revenue Starts 2026 Ahead of Forecasts

Detroit’s three commercial casinos posted a stronger-than-expected start to 2026, data from the Michigan Gaming Control Board show.

Key Takeaways:

- Detroit’s three casinos report better-than-expected January gaming revenue of $103.1 million

- MGM leads market share with nearly 50%, while traditional gaming remains dominant

- Online gaming continues to expand, exceeding $3 billion in gross revenue for 2025

Gaming revenue tops $103m as MGM leads market

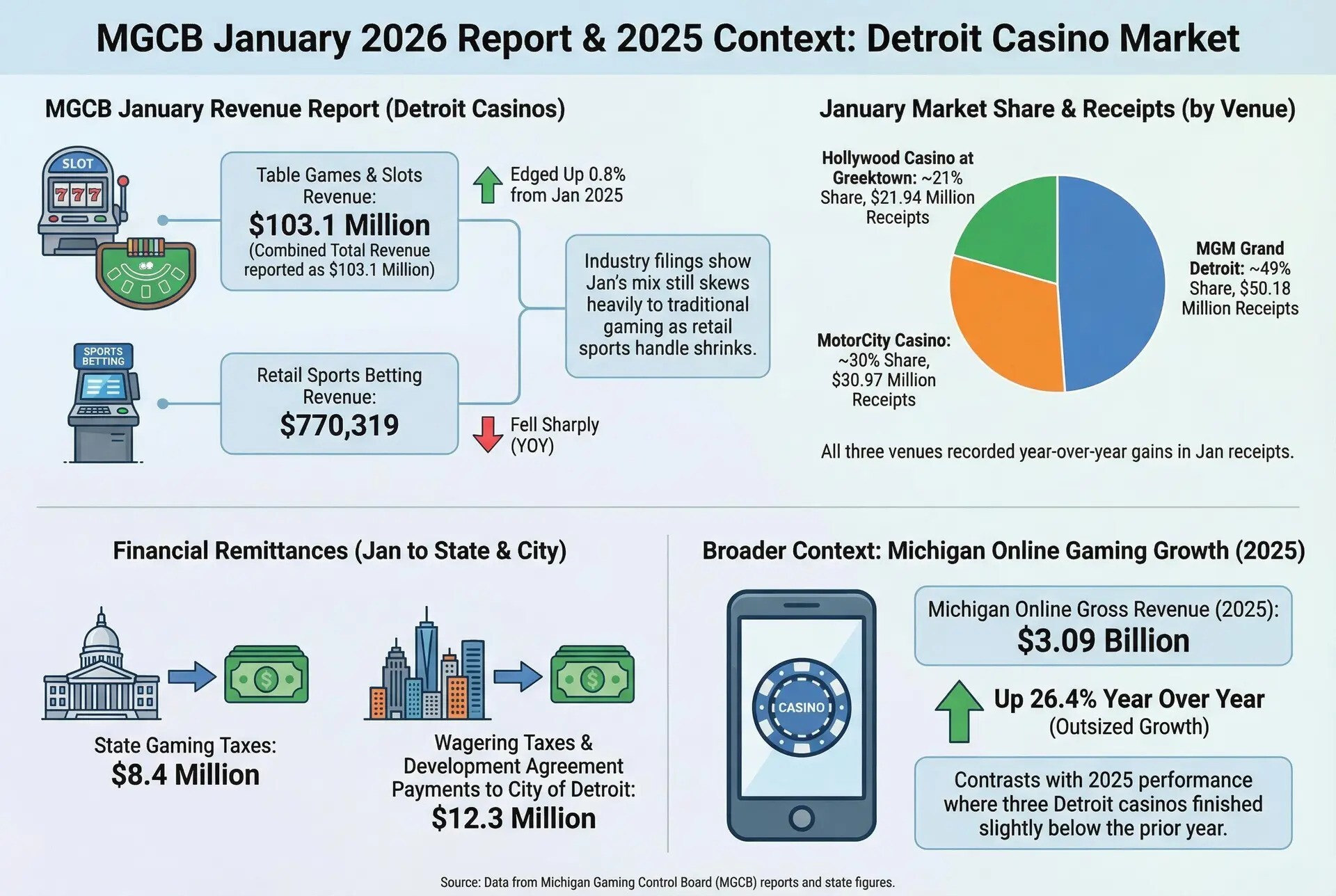

According to the report by the MGCB, table games and slots produced $103.1 million in January and retail sports betting added $770,319, with the agency noting the properties combined for $103.9 million in gaming revenue.

The casinos remitted $8.4 million in state gaming taxes and $12.3 million in wagering taxes and development agreement payments to the City of Detroit.

All three venues recorded year-over-year gains: MGM led with roughly 49% market share and $50.18 million in January receipts, MotorCity held about 30% with $30.97 million, and Hollywood Casino at Greektown accounted for 21% with $21.94 million. The three casinos were recently approved for renewed licenses until September 2026.

Online growth reshapes Michigan’s broader market outlook

Table game and slot revenue edged up 0.8% from January 2025, while retail sports wagering fell sharply. Industry filings show January’s mix still skews heavily to traditional gaming even as retail sports handle shrinks.

The January result follows a 2025 performance in which the three casinos finished slightly below the prior year, and it arrives amid outsized growth in Michigan online gaming; state figures show $3.09 billion in online gross revenue for 2025, up 26.4% year over year, per Saturday Tradition. Seasonal patterns, including typically lighter January and February receipts and a stronger March, suggest the next two months will be critical for assessing momentum through 2026.