Casino Exclusion Filings Rise in Macau Amid Post-Pandemic Rebound

Macau’s casino exclusion filings surged in 2025, mirroring the market’s post-pandemic rebound.

Key Takeaways:

- Casino exclusion applications in Macau increase by 67.9% in 2025

- Self-exclusions account for 74.3% of filings, a significant rise

- Industry shifts suggest changing patterns of play post-pandemic

According to a Gaming Inspection and Coordination Bureau (DICJ) report, applications climbed 67.9% year-on-year to 952, with self-exclusions accounting for 828 cases, a 74.3% rise. Third-party exclusions accounted for 124 cases, a 38.4% increase, underscoring that most people are choosing to bar themselves rather than requiring court-ordered measures.

Casino Exclusion Trends Signal Shifting Market Conditions

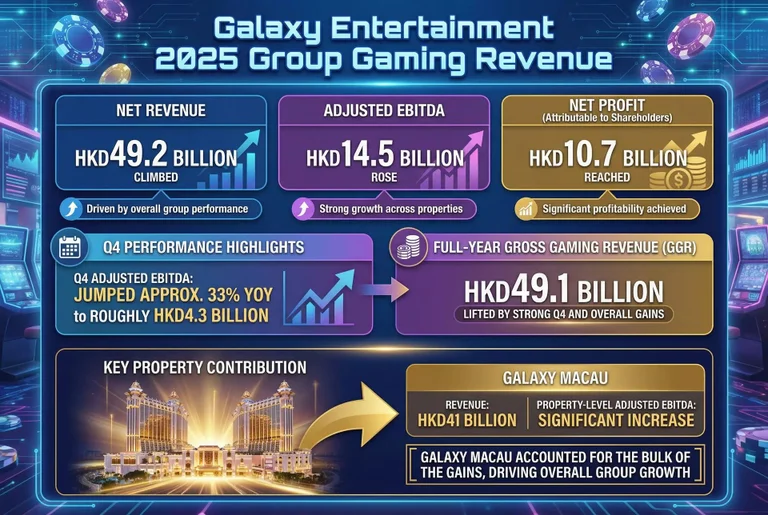

The spike aligns with fuller reopenings and higher gaming volumes that followed COVID-era travel restrictions, when casino exclusion requests were far lower. The trend comes as Macau’s casinos also posted a sharp rebound in gross gaming revenue during 2025, highlighting a broader return of visitation and play alongside increased engagement with responsible gambling mechanisms

Industry data shows a contrast between pandemic troughs and the current uptick, while Financial Intelligence Office filings indicate a concurrent 6.1% fall in suspicious transaction reports in 2025 compared to 2024.

Law No.10/2012 remains the backbone of exclusions, empowering the DICJ to process self‑ and third‑party requests under a maximum two‑year bar. Cumulative figures since the law’s enactment in November 2012 show 5,789 exclusion cases as Macau continues to balance market growth with consumer protections.