The Death of the Gambling Expert

Let’s preface it this way:

First, about 95 percent of all gambling stories are either blackjack or poker stories. Most everything else is either about sports betting or degenerates.

Second, if you are under the age of 40, you will probably never know what it was like to count cards and go from casino to casino across the U.S. and have a plausible expectation that you could beat blackjack—and therefore the casino. Meanwhile, the odds that a new player can make it as a professional poker player are probably worse now than at any point in the history of the game.

As beatable blackjack games have all but disappeared and the poker boom of the 2000s is long over—topics we have discussed ad nauseum over the past two decades going back to my very first piece on the gaming industry in September 2003 when Harrah’s Entertainment purchased Horseshoe Gaming, effectively marking the beginning of the very end of 3:2 single-deck blackjack—the number of avenues where a reasonably intelligent person can walk into a casino and plausibly be even a competent gambler is approaching absolute zero.

That said, the rising house advantage on the casino floor—and specifically the push to kill blackjack—over the past few decades has had an unintended consequence.

Is the Traditional Brick-and-Mortar Casino Industry Shrinking?

The reality right now is that the traditional brick-and-mortar slot/table games casino is no longer a growth driver in the gaming industry. Per the American Gaming Association (AGA), commercial casinos across the U.S. posted a record $49.4 billion slot plus table game gross gaming revenue (GGR) in 2023, but that only represented a gain of 3.3 percent over 2022—a pace slower than inflation.

The traditional U.S. casino industry effectively shrunk in real terms. And through June year-to-date, traditional slot and table game GGR increased only 1.1 percent over the same period in 2023.You might be saying that gross gaming revenues in Clark County, Nevada—encompassing Las Vegas—set a record three years in a row, reaching $11.4 billion in 2021, $12.8 billion in 2022, and $13.5 billion in 2023. But the pre-pandemic peak of $10.9 billion actually came in 2007, for a 16-year growth of 24 percent total, or half of cumulative inflation over the same period.

Now, this is not the whole story on the Las Vegas Strip, where non-gaming revenues have grown significantly and now represent two-thirds of Strip revenues.

That said, the gambling part—the most fundamental part—of the gaming industry has not been a growth driver for a very, very long time, and may never be again.

The Rising House Advantage and The Death of Blackjack

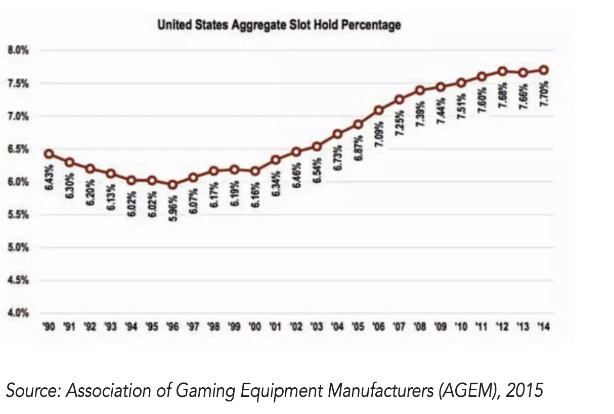

In 2015, the Association of Gaming Equipment Manufacturers (AGEM) commissioned a report by Applied Analysis titled “Slot Market Assessment: Analysis of Industry Data.” The report included the graph below, showing the rise in the aggregate slot hold percentage in 16 states (representing effectively the commercial gaming industry plus two Indian casinos in Connecticut) from 1996 to 2014.

The UNLV Center for Gaming Research has a similar report dated July 2024 titled “Nevada Slot Machines: Historical Hold Percentage Variations” covering Nevada from 2004 to 2024. This report shows the aggregate hold percentage across the state of Nevada rising in virtually a straight line from 5.72 percent in 2004 to 7.26 percent in 2024 (the Las Vegas Strip saw a rise from 6.52 percent in 2004 to 8.12 percent in 2024, while Downtown Las Vegas went from 5.87 percent in 2004 to 8.63 percent in 2024).

The slot hold percentage is a direct reflection of the underlying programmed house advantage in slot machines, factoring some natural variance. But for table games, “hold percentage” is actually a completely different statistic—calculated as a percentage of the drop—with relatively little relation to the house advantage.

That said, we’ve seen a similar rise in the house advantage in the table games pit, though it shows up in two different ways:

- Rule changes in blackjack. The advent of continuous shuffling machines (CSM) in the 2000s was intended to make card counting impossible, reducing the number of beatable blackjack games on the floor. The shift from 3:2 single-deck blackjack games (-0.15 percent house advantage) to double-deck and multi-deck blackjack games (-0.5 percent house advantage) resulted in an increase in the house advantage, while the introduction of 6:5 single-deck blackjack games in the early 2000s provided another jump (moving from 3:2 to 6:5 pays for blackjack adds 1.39 percent to the house advantage). Now we have even higher-edge 6:5 multi-deck games and even electronic table games, while other variants like the now seemingly ubiquitous Free Bet Blackjack also have a higher house advantage over traditional 3:2 blackjack.

- Replacing blackjack games outright with higher-edge games, and/or eliminating blackjack games entirely. That is, avoid dealing blackjack at all.

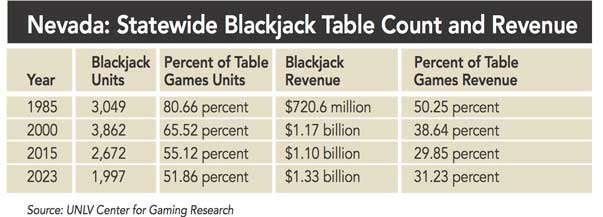

In February 2015, I wrote a piece titled “The Death of Blackjack and What Games Are Replacing It.” The table below is an updated version of a table in that piece. In 1985, blackjack was by far the dominant game on the casino floor, representing 81 percent of table game units in Nevada and 50 percent of table games revenue.

By 2000, blackjack only represented two-thirds of table game units and 38.6 percent of table games revenue. And by 2015, blackjack was only 55 percent of table game units and under 30 percent of table game revenue (certainly the growing prominence of higher-end baccarat play primarily on the Las Vegas Strip has had an impact on blackjack’s revenue share figure).

Moreover, there were only 2,672 blackjack units in the state of Nevada in 2015, down from 3,862 in 2000. As I wrote then, what we had seen in that time frame was a concerted effort to simply replace blackjack games with uncountable, higher-edge games like Three Card Poker, Crazy 4 Poker, High Card Flush and Ultimate Texas Hold’em.

And in 2023, there were only 1,997 blackjack units in the state of Nevada—about half its 2000 peak—representing only 52 percent of table game units and 31 percent of table game revenue. Incidentally, the state of Nevada also peaked at 5,894 total table game units in 2000, and was down to 3,851 units in 2023; the removal of 1,865 blackjack units makes up almost the entire difference.

Worse, it is unclear how many of those remaining blackjack units are CSM and/or higher-edge abominations (6:5 blackjack) or other higher-edge variants (e.g., Free Bet Blackjack). What is clear, however, is that table game pits are getting smaller and/or disappearing entirely (see Slots-A-Fun), and that the higher-edge version of “blackjack” is not beating inflation over the last two decades.

Poker: The Skill Gap Problem/The End of the Poker Boom

On Dec. 23, 2011, the U.S. Department of Justice announced that it had changed its stance on online gaming, saying that the Interstate Wire Act of 1961—previously cited in declaring online gambling illegal in the U.S.—only applies to sports betting. The industry quickly mobilized—by August 2012, Nevada had already passed legislation legalizing online poker and had already begun issuing licenses, with South Point Poker becoming the first company granted a license as an online poker room operator. Meanwhile, Delaware had legalized a full suite of online casino games.

The AGA had published a white paper saying that “millions of Americans spend $4 billion every year to gamble online” on unregulated, offshore sites, while Caesars Entertainment cited Wall Street estimates pegging the potential online gaming market at $6 billion to $10 billion. Meanwhile, poker players were clamoring for a return to the Party Poker glory days of unregulated online poker in 2006, when poker players had a truly global market and every game imaginable at their fingertips, while poker was still easy to beat.

But as I wrote in October 2012 (“Sorry Mr. Online Poker, Nobody Cares About You”), there were a few basic problems here:

- The online poker opportunity was only a fraction of a fraction. At the time, we were really mostly only talking about poker in the near term, so the potential opportunity was not $6 billion to $10 billion but some fraction of it. Moreover, when the AGA said that “millions of Americans spend $4 billion every year to gamble online,” it was talking about gamblers in 50 states. In that sense, the legalization and regulation on online poker would represent a restriction on online gaming, as it would be legal only in the states that would opt in.

- From an operator standpoint, online poker is a winner-takes-all space. At the time, PokerStars controlled basically half the global online poker market after acquiring No. 2 operator Full Tilt. PokerStars benefited greatly from strong network effects where online poker players continually gravitate to the biggest site with the greatest volume and the greatest variety of games and offerings, in the same way that eBay benefits from network effects where buyers and sellers gravitate to one site. Second place is ultimately a losing proposition.

- The skill gap problem. Poker—as it seems all player-versus-player gambling games are—is fundamentally a self-defeating game.

Here’s the reality about poker:

- In poker, the money isn’t so much won by good players making good plays as it is lost by bad players making mistakes.

- The poker boom was fundamentally built on easy money chasing easy money.

- As players in the existing player pool get better over time, the odds increase against new and bad players.

- Over time, the losing players quit, leaving a tougher and tougher player pool.

- As the losing players quit and the player pool gets tougher, the win rates of better players shrink, while the marginal pros can no longer beat the rake and ultimately get grinded out.

- As games get tougher, existing players quit, and new players get wiped out faster and faster, games ultimately start to die.

This is not unique to poker, but seems to be a general bug of player-versus-player games. And during the poker boom, we had greater access to information, more access to games, and more computing power than any generation that came before us—it’s not a coincidence that many of the best-selling books in the history of the game were written during the poker boom by guys in our 20s.

As of 2024, only eight states have legalized online poker—Nevada, Delaware, New Jersey, Pennsylvania, Michigan, West Virginia, Connecticut, and Rhode Island—but only four of those states are even operating (NV, NJ, PA, MI). And despite three initial entrants in Nevada, WSOP.com has been the only online poker site in the state since November 2014.

The Languages of Gambling

What should be understood is that gambling exists as a series of languages.

Blackjack is the historically beatable card game of skill, where the player plays against the house and the house has a fixed strategy. Poker is a player-versus-player skill game that depends on a market of players to play it, and where the house takes a rake off of cash games and an entry fee from tournaments.

Craps is a dice game with a variety of wagers of varying edges (ranging from zero for odds wagers to a lot for any wager with a name) built around the base Pass Line wager. Roulette is a wheel game where the player places various bets on a map based on where the ball will drop.

Sports betting is house-banked wagering on sporting events where the house generally tries to balance the wagering on both sides of a given proposition while charging a premium (the vig) to take the wager.

If you want to understand traditional brick-and-mortar casino gambling, the two games you absolutely need to understand are the beatable card games: blackjack and poker.

In 2015, Daily Fantasy Sports (DFS) was the rage with basically two major players: DraftKings and FanDuel. Like online poker, the DFS market inspired very lofty projections from analysts everywhere. The problem was that—as I wrote in a June 2015 piece called “DFS and Lessons from Poker”—DFS had all the same problems of online poker, except worse.

DFS was purely a data-driven game that could be solved by brute quantitative force, and without any of the nuances of poker (like position, check-raising, c-betting, 3-bet pre-flop frequencies, or bet-sizing). And like poker, DFS was a player-versus-player game—from which the operator took a portion of the entry fee as rake/revenue—that depended on network effects to create the biggest player pool possible, where there is ultimately room for basically one player in any given market.

As I wrote then, “I find it likely that DFS is going to run into a buzzsaw, where attrition rates are too high and the influx of new players will not be enough to mask the skill gap.” And “in contrast to poker, I don’t see this taking a decade to occur.”

As it turned out, in November 2016, FanDuel and Draft Kings announced their intent to merge, before getting blocked by the Federal Trade Commission. But then the entire complexion of sports betting had changed when in May 2018, the Supreme Court declared the Professional and Amateur Sports Protection Act of 1992 (PASPA)—which had effectively outlawed sports betting across the United States except in a handful of states—unconstitutional.

This opened the floodgates for sports betting across the country, where it is now legal in some fashion in 38 states plus Puerto Rico and Washington, D.C. That said, the impact of sports betting is primarily online.

The Death of the Gambling Expert

If you understand the above, there are three underlying realities:

- There is no new blackjack game coming to create a demand boom on the casino floor. We’re not going to see new beatable games to drive demand on the casino floor.

- The poker boom is over and probably not coming back. Meanwhile, other player-versus-player booms (like DFS) will likely be shorter-lived, as games are solved faster—and thus markets will dry up faster than ever before.

- There is nobody left to solve these problems. Because beatable blackjack has been dead for over a decade and the poker boom ended over a decade ago, there’s basically nobody left who is an expert on these things.

You can’t use the force if you’ve never seen a Jedi and don’t know the force exists.