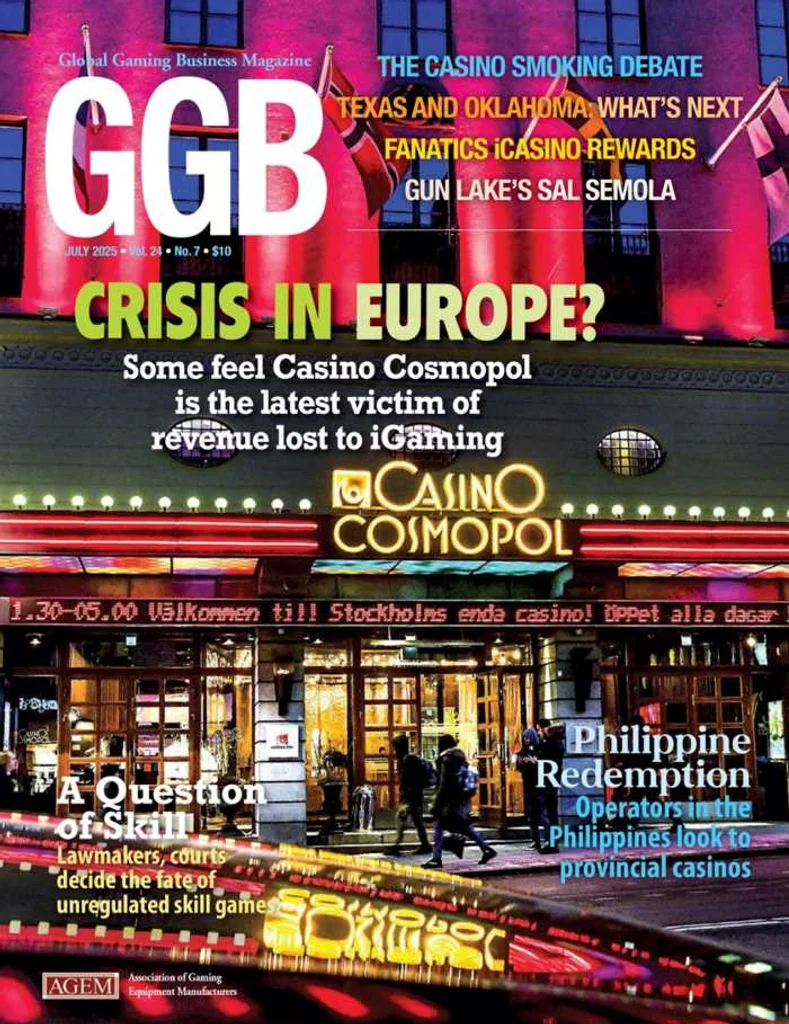

Online vs. On Land

On January 1, 2026, Casino Cosmopol in Stockholm is set to close its doors, marking the end of land-based casino gambling in the country. The chic Stockholm venue has been the country’s sole legal casino since February 2024, when the government moved to close Casino Cosmopol’s sister sites in Gothenburg and Malmö. A further site in Sundsvall had already closed back in 2020.

When the government announced in April its plans to shutter operations, nobody—least of all monopoly license-holder Svenska Spel—was surprised. With profits and visitor numbers plummeting, the writing had been on the wall for Cosmopol’s Stockholm branch for some time.

For Svenska Spel CEO Anna Johnson, it is clear where to place the blame.

“The rise of online casinos and other remote gambling forms has meant that traditional physical casinos, such as those operated by Casino Cosmopol, have seen a decrease in visitors and, consequently, in profits,” she says.

With iGaming offering 24/7 access and “more attractive promotions,” she adds, physical venues have found it hard to maintain their relevance.

Heated Debates

Claims of cannibalization—in particular, iGaming operators siphoning profits and players from retail casinos—will be familiar to anyone following the casino sector in the U.S.

There, in Maryland and elsewhere, both regulators and major brick-and-mortar brands have been leading the charge against the expansion of the online sector.

In Europe, meanwhile, a similar story can be told in jurisdictions that are planning to regulate online casino and betting products—or those who have recently done so. In Sweden, for example, online casino licenses have been available since 2019, while the Netherlands finally passed its long-awaited Remote Gambling Act in April 2021.

In France, delays in the introduction of an online gambling bill are in large part due to ongoing debates about cannibalization. When the government drafted plans to regulate remote casino products as part of its 2025 budget back in October, the move sparked a furious backlash from land-based operators.

Casinos de France, the trade association representing the country’s prominent land-based casino sector, has been the most vocal opponent of the plans. Allowing online casino products would have “catastrophic” consequences in France, they argue, including the loss of land-based GGR and around 15,000 casino jobs.

“People say France is the exception online, but it is also an exception offline with the number of (land-based) casinos on its territory and the deep links they have with each department and commune they operate in,” Casinos de France CEO Philippe Bon told Gaming & Co.

“Within that context, it is not illogical that online casino is not regulated, or, if it is legalized, that it should be according to a particular model.”

The model proposed by the trade body would see licenses exclusively handed out to current land-based operators in the country. Defending the proposals, CdF Vice President Fabrice Paire described it as a means of safeguarding the land-based sector.

“Online casino regulation should not be disconnected from land-based casinos,” he told French media sources. “We know it will be toxic or even fatal for some of them.”

So far, the efforts of France’s retail casino operators have been enough to at least stall plans to regulate the online market. Instead, politicians opted to launch a six-month public consultation, with the potential to reintroduce a bill in late 2025.

Digital Transformation

In Sweden, the steep downward trajectory of Casino Cosmopol sounded the death knell of the legal retail casino sector.

During 2024, the company saw profits slump by 65 percent to SEK165 million (US$1.75 million), driven largely by the closure of two of its sites at the start of the year.

The situation got so bad that taxpayers in Sweden were forced to bail out the struggling venues, until Parliament ultimately decided to end land-based casinos in the country altogether.

In the meantime, well-known Swedish iGaming brands have been thriving. Betsson, for example, reported its “best year ever” in 2024, with €179.5 million of its some €1.1 billion in revenues netted in the Nordic countries (although profits dropped by €16.6 million in this region compared to the previous year).

Sweden stands out as the European jurisdiction with the highest market share among online operators. According to the European Gaming and Betting Association (EGBA), 68 percent of the country’s gross gambling revenue is generated online, compared with just 32 percent in retail settings.

According to Gustaf Hoffstedt, secretary general of the Swedish online gaming association BOS, these stats show that Swedes are ahead of the curve when it comes to digital transformation.

“Swedes tend to be quite quick to adopt new things and embrace change,” he says. “That includes transitioning away from many land-based formats, not just gambling. So it’s not surprising that Sweden, along with neighboring countries like Denmark and Norway, are following similar developments.”

For Hoffstedt, the digital transformation in gambling is as natural as the transition away from retail travel agents toward booking a holiday online. In the U.K., for example, the presence of physical betting shops is surprising to anyone visiting from Sweden, since they’ve long since disappeared from Swedish streets.

The adoption of online gambling products also occurred early in Sweden—long before the government introduced its licensing scheme in 2019.

Companies like Unibet, NetEnt, Evolution and Betsson were all founded in the Scandinavian nation—some, like Unibet, emerging way back in the 1990s—but gained their initial licenses in offshore jurisdictions like Malta, Gibraltar and the Isle of Man due to the former monopoly system.

Nevertheless, the emergence of these innovative brands speaks to Sweden’s reputation as a country of early adopters.

But while digital transformation has happened particularly swiftly in the Nordics, the growth of online gambling seems to be outpacing that of its land-based counterparts everywhere.

In 2019—the year before the Covid pandemic struck a blow to the land-based sector—online operators accounted for around a quarter of the total gambling market in Europe. Of the €102.7 billion in GGR generated that year, €26.7 billion was earned by white- and grey-market operators online, while €76 billion in GGR was netted by land-based operators.

By 2029, however, the EGBA estimates that online gambling and land-based gambling will be heading toward parity, with a 45-55 split of the market.

In sports betting and casino, revenues generated online are already far exceeding those generated in retail venues. Lottery and gaming machines, meanwhile, skew the numbers back toward land-based operations.

‘No Evidence of Cannibalization’

The key question in the current cannibalization debate is whether the growth of the online market is really siphoning profits away from the land-based sector. In the view of the retail casino lobby in places like France and the United States—and in the view of Casino Cosmopol operator Svenska Spel—the answer to this question is “yes.”

According to the EGBA, however, recent studies and projections of the European gambling market tell a different story.

“There is actually no evidence of cannibalization between online and land-based gambling in the European gambling market as a whole,” the trade body told GGB. “The growth in the European market has been gradual, and demonstrates that online and land-based sectors are complementary rather than competitive, with total European gambling revenue expanding from €123.4 billion in 2024 to €149.2 billion in 2029.”

The European trade association holds that, while online gambling is growing faster—projected to grow at 6.9 percent annually from €47.9 billion in 2024 to €66.8 billion by 2029—the land-based sector also continues to grow in absolute terms over the same period. Here, GGR is projected to increase by 1.8 percent annually, from €75.5 billion in 2024 to €82.4 billion by 2029.

This points to the potential for omnichannel operations to thrive, particularly in different sectors of the market.

“The reality is that consumers often use both channels for different needs,” the EGBA explained. “For example, they might buy a lottery ticket in a retail outlet but place online bets on sports.”

This view was supported by a 2024 U.S. study that aimed to debunk previous “flawed” research on industry cannibalization. Conducted by Eilers & Krejcik Gaming (EKG) and commissioned by the iDEA Growth trade body, the study looked at market developments in the six states that had legalized iGaming at the time.

As opposed to a parasitic dynamic, researchers tracked a quarterly revenue boost of 2.44 percent after remote casino products were introduced, pointing to a more symbiotic relationship. Casino owners reported their revenues had either improved slightly or remained roughly the same after online regulation.

“The closer you look at the data, the better it is for the casino markets that have added iGaming,” EKG Managing Director Matt Kaufman explains.

For Kaufman, the vibrant online sector—with its younger, largely male audience—was helping to halt land-based casino’s inevitable decline.

“States that have introduced iGaming have been materially more likely to see that decline flattening, and at times even returning to growth, compared to states with only land-based casinos,” he says.

Speaking to iGaming Business in March, BetMGM CEO Adam Greenblatt took a similar position, slamming cannibalization claims as “scare-mongering” by retail incumbents.

The impact of the online sector had been distorted by the pandemic, Greenblatt contended, leading lobbyists to overstate the damage to retail businesses.

For the chief executive of the omnichannel brand, success requires bridging the innovation gap between the land-based and online sectors. Just as retail and gastronomy have undergone “revolutions” in recent years, entertainment venues like casinos need to evolve in order to keep luring in the crowds.

Back in Sweden, BOS Secretary General Hoffstedt sees the lack of innovation at Casino Cosmopol as one of the major factors behind its demise.

“Casino Cosmopol remained a monopoly to the end, which meant no competition or innovation,” he says. “If there’s no competition, innovation dies.”

Despite the shift to online, Hoffstedt says land-based casinos can fulfill an important, if slightly niche, role in the gambling ecosystem, offering a touch of glitz and glamour to the tourism and leisure crowd.

“I believe land-based casinos could be profitable in cities like Stockholm, Malmö, and Gothenburg—if they were open to private operators,” he says. If the government were to reverse its decision to ban land-based gambling, a number of BOS’ remote operators would likely be interested in a license.

As Hoffstedt points out, many operators in the online sector have a direct interest in keeping a healthy land-based sector alive.

“Companies like Evolution partner with land-based casinos, which adds authenticity to their online offerings,” he explains. “Lose that, and you lose a key selling point.”

Instead, the move to end land-based casinos in Sweden will likely fuel black market operators and drive customers to the illegal market.

Restrictive Regulations

Caught between cutting-edge online brands and a stiff, state-monopoly-run land-based sector, the gambling market in Sweden presents a particularly strong contrast between the two channels.

This, alongside the trend towards digitalization, could have played a role in its decline.

For the EGBA, the real threat in the gambling sector is not cannibalization between different channels but rather the black market, which can thrive in overly strict regulatory settings.

A key example of this is Germany, where a legal framework for online casino and sports betting has been in place since 2021. Despite being Europe’s third-largest gambling market, legal online gambling makes up just 22.6 percent of the country’s total revenues.

Rather than boosting the land-based casino sector, critics say that Germany’s ultra-strict regulations and high taxation online have driven players into the hands of the black market.

“Black market operators compete with licensed online operators and have a competitive advantage because they do not face any regulatory constraints,” the EGBA explained.

“This creates a lose-lose scenario: Black market operators capture revenue from the regulated market, consumers receive less protection, and the state loses tax revenue to offshore operators.”

In the Netherlands, meanwhile, Casino Holland recorded a severe dip in profits at the end of 2024, despite visitor numbers at its land-based venues rising to 5.2 million per year. According to the operator, a 26.6 percent drop in online profits can be attributed to newly introduced deposit limits, which may have driven customers to the unregulated market.

Hybrid Models

For Svenska Spel’s Johnson, the key to ensuring the success of both land-based and online gaming is to “create a more seamless and complementary offering” between the two channels. This could include hybrid models where players interact with brick-and-mortar casinos online, she explains.

The EGBA also believes that retail and remote gambling can end up working in tandem. It laments the fact that many regulations in Europe artificially favor one channel over another.

“The key to solving this is creating regulatory frameworks that allow licensed operators to offer attractive, competitive products that will encourage players to play within the regulated market, combined with stronger enforcement against black market operators,” the trade body said.

“The goal should be fostering healthy competition within the licensed market—both land-based and online.”