Gaming 2.0: The Industry Under Siege

The casino industry faces a wave of new online competition that threatens to redefine gambling itself and upend current regulatory regimes.

In a stealth offensive, new gaming applications are exploiting gaps in regulation and generating innovative new forms of gaming entertainment that skirt the edges of what traditionally has constituted gambling. These new arrivals include sweepstakes casinos, offshore crypto casinos, social sports platforms, DFS 2.0 and sports prediction markets.

They are now the fastest-growing segments of the industry and are attracting both investment capital and regulatory concern.

After a remarkable period of expansion, traditional land-based casino gaming is entering a period of maturity as greenfield markets become scarce. The major opportunities remaining are downstate New York, Georgia and Texas. Similarly, the sports betting explosion has ended. Since PASPA’s repeal in May 2018, nearly 40 states have legalized some form of sports wagering, but new markets are proving harder to conquer.

Internet gaming, which has provided massive revenues in New Jersey, Michigan and Pennsylvania, has failed to expand beyond seven states amid new controversies over problem gambling, land-based cannibalization and potential job losses. With growth fading in traditional gaming, new online options have arisen to fuel rapid growth around its edges.

Enter Gaming 2.0. Aristotle supposedly coined the phrase “nature abhors a vacuum,” and the gaming industry is no exception. As growth has slowed in conventional gaming, visionary entrepreneurs and grifters alike have established a wide array of “alternative gambling” options. These operations are agile, well-funded, aggressively scaling up and currently running ahead of state regulators. Collectively, they present a fundamental challenge to conventional Gaming 1.0. Let’s briefly examine the major verticals.

Sweepstakes Casinos

Sweepstakes casinos are an outgrowth of longstanding social casinos where players can purchase tokens or coins for a fee and play casino games online. Traditionally, you won tokens by playing, but you couldn’t cash out for actual money.

Sweepstakes adds a “freemium” twist where a primary currency of “gold coins” can be purchased to play for free, but with a secondary currency of “bonus coins” or “sweep coins” available via award or purchase. These tokens can be exchanged for prizes with real money value or actual dollars.

Sweepstakes adds a “freemium” twist where a primary currency of “gold coins” can be purchased to play for free, but with a secondary currency of “bonus coins” or “sweep coins” available via award or purchase. These tokens can be exchanged for prizes with real money value or actual dollars.

Is it gambling? The legal definition of gambling requires the presence of three elements: 1) consideration (something of value or a payment); 2) chance; 3) a prize. In a Gaming 1.0 casino you must pay to play, and you must play to win. Social casinos do not offer a prize, but sweeps casinos do, so the legal argument revolves around consideration.

Advocates claim that there is no consideration involved, because you can play for free with gold coins. Opponents say that if there is a prize and you must pay to access it, then it is gambling. Several senior U.S. regulators agree with the latter explanation.

Moreover, the incredible growth of sweepstakes casinos over the past five years compared to social casinos with similar content argues that there is something more than “play for free” going on here.

According to Eilers & Krejcik Gaming, sweepstakes casinos are the fastest-growing gaming category in the U.S., increasing 70 percent on average over the past four years. EKG estimates sweeps had 2024 revenue of $3.45 billion and projects them to generate $4.9 billion in 2025, an increase of 42 percent.

The most successful operator, Virtual Gaming Worlds (VGW), is the sixth-largest company in Australia from posting 2024 FY revenue of $4.15

billion, the majority of which comes from North America. The 42-year-old founder, Laurence Escalante, started the company in his basement and now owns a collection of more than 120 supercars, his own jet and a Lamborghini yacht.

Clearly, sweepstakes have been good for “Lambo Larry,” as he is known Down Under. Chumba Casino, the most prominent VGW skin, features Ryan Seacrest as a celebrity spokesperson, and other sites have hired Paris Hilton, Drake and NBA players to popularize their brands.

Crypto Casinos

Offshore online casino operators have been around for 30 years, but crypto casinos take this to a new level. Utilizing blockchain technology, crypto casinos offer anonymity, with only a digital

wallet address needed to register. They span international borders and provide enhanced security, instantaneous payment transactions and much lower fees for operators and players.

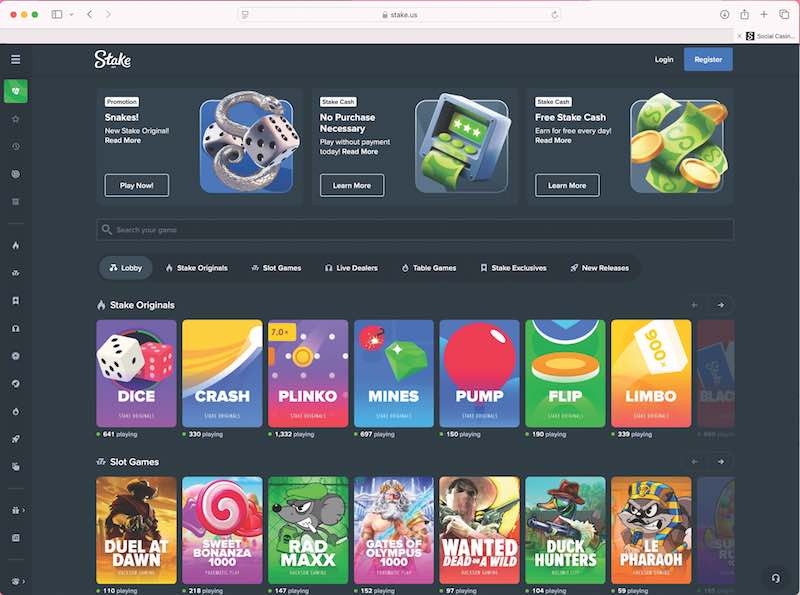

Regulatory issues abound, as KYC is absent and AML oversight is negligible. The major operator in this category is Stake, run by a billionaire duo with a license in Curacao, financial hub in Cyprus and corporate offices in Melbourne.

Stake processes a volume of crypto transactions larger than many major banks but with zero oversight. It shifts profits to the most tax-friendly locations. According to Forbes, Stake generated $4.7 billion in 2024 despite crypto casinos being illegal in the U.S.

DFS 2.0

DFS 2.0, or DFS+, is the next evolution of daily fantasy sports (DFS). Traditional fantasy sports has been played for years as a season-long contest between individuals. Daily fantasy sports compressed the timeline to 24 hours as DraftKings and FanDuel unleashed a torrent of advertising for the 2015 NFL season.

While questions of legality arose at that time, DFS was still primarily a peer-to-peer contest. DFS 2.0 tests the boundaries of peer-to-peer with head-to-head “pick ’em” matchups, where users are effectively playing against the house. The “over/under” terminology of regulated sportsbooks becomes “higher/lower” and multiple prediction “lineups” mirror player prop parlays.

The biggest players in this field are PrizePicks, named to the Inc. 5000 list of fastest-growing companies with purported three-year growth of 3,712 percent, and Underdog, whose recent $70 million capital raise now values the company at $1.23 billion. PrizePicks and Underdog were among the top 10 sports betting app downloads in December 2024, and their success has engendered a raft of similar startups.

Social Sports

Social sports platforms transfer sweepstakes casino practices to sports. Billed as free-to-play sports betting, these apps require no deposit to play. Bets are fun “sports predictions,” and cash wins are “prizes.”

Like sweeps, there are dual currencies available, one a token and the other with real-money value. The major brand in this category is Fliff, based in Philadelphia, but startups are flocking to the space.

Social sports platforms are currently available with no restrictions to anyone over 18 years old in some 40 states, although the list is shrinking. Unsurprisingly, Fliff is very popular among college students, and its high-volume markets include states like Texas and California where sports betting is not yet legal. To cement the connection with sweeps, Fliff recently launched its own sweepstakes casino, Sidepot, where players can use Fliff Coins or Fliff Cash to wager on casino games.

Prediction Markets

A greater threat to regulated sports betting may come from sports prediction markets run by trading exchanges. These platforms treat single-game sports wagers as future events contracts. Players buy shares of an outcome, so there are no odds or bookmaking. Exchanges can offer a lower “vig” as peer-to-peer operators, rather than have customers bet against the house.

The most alarming part is that these sports prediction markets would be regulated by the Commodity Futures Trading Commission (CFTC). Federal regulation implies that these products would be available in all 50 states to anyone over 18, regardless of whether they have legalized conventional sports betting. This would bring sports betting to states like California, Georgia, Minnesota, Texas and even Utah, effectively disenfranchising voters on the issue and overturning the state regulatory model that has historically overseen gambling in the U.S.

The most aggressive company in this arena is Kalshi, which took contracts on Super Bowl LIX, but others include Robinhood and Crypto.com, while exchange heavyweight Polymarket has also expressed interest. It is highly likely that sports prediction markets will soon be endorsed by the CFTC given that President Donald Trump’s nominee to head that agency, Brian Quintenz, is a Kalshi board member—and to seal the deal, in January Kalshi added Donald Trump Jr. as a strategic adviser.

If sports prediction markets move forward, expect their products to quickly evolve from single-game contracts to player props and parlays, potentially becoming indistinguishable from current sportsbooks.

Kalshi is already offering odds on the migration of NFL coaches, and its advertising mimics the ubiquitous ads we see in sports betting states on every televised event. Sportico reported that Kalshi filled 63 percent of its Super Bowl futures contracts after the starting whistle, which is clearly in-game betting, and the company reported a 1,000 percent increase in new traders the week before the Super Bowl.

And in case you were wondering what other big dogs might get involved, Polymarket, DraftKings and FanDuel have all publicly expressed interest.

Regulatory Reaction

State gaming regulators are awakening to the challenge posed by these new online forms of gambling. Presently, there is little oversight, compliance standards or player protections for Gaming 2.0 apps. But lately, regulatory agencies are issuing cease-and-desist letters to offshore operators and banning or placing restrictions on domestic companies.

More needs to be done to clarify whether these new concepts are actually gambling. If they are determined to be, then state attorneys general must enforce the law and ensure these new actors conform to regulatory and tax regimes that other gaming operators must comply with. In cases where they are determined not to be gambling, player protections must be put in place and KYC procedures, AML oversight and taxation addressed.

The trend of Gaming 2.0 intensified rapidly during the Covid-19 pandemic, and it has grown since by filling the entertainment needs of people around the fringes of regulated gaming. Regulators need to catch up and play offense as well as defense.

Tribal Gaming Response

Gaming 2.0 is a clear and present danger to the commercial gaming industry but a particular challenge for tribal government gaming.

Tribes that have negotiated agreements with state governors trust their compact rights will be protected by the state. The growing array of alternative gaming options is eroding that trust and negatively impacting tribal gaming revenues and the compact payments made to state governments. As awareness of the Gaming 2.0 threat grows, we are seeing increasing signs that the collective industry is fighting back.

The California Indian Gaming Association (CNIGA) recently held its Western Gaming Conference at the Pechanga Casino Resort in Temecula. My business partner Victor Rocha was invited to present a half-day educational deep dive for CNIGA.

Rocha’s educational sessions covered all these new online forms of gaming. In my own presentation to open the segment, we were able to show that, using EKG’s revenue estimates and rough calculations of California’s share of the U.S. population, sweepstakes casinos generated $1.5 billion in GGR over the past seven years within the state.

While this amount would not have been directly subtracted from casino count rooms, it undeniably has an impact on statewide gaming spend. Sports prediction markets could play havoc with the small progress that has been made in the contentious journey to legalize sports betting in California. We expect tribes to be paying close attention to future developments in Gaming 2.0.

Other efforts to raise awareness are apparently working. Recently, bills have been filed to either restrict prizes or ban sweepstakes casinos completely in Connecticut, Florida Maryland, Mississippi, New Jersey, New York and West Virginia.

Regulatory authorities in Illinois, Ohio, Maryland, Montana, Nevada and New Jersey have all issued cease-and-desist orders against Kalshi, and several have included Robinhood and Crypto.com. While Kalshi’s legal response has met with initial success in Nevada and New Jersey, the Nevada Gaming Control Board’s assertion that event contracts are “unlawful in Nevada, unless and until approved as licensed gaming by the Nevada Gaming Commission” is likely to find support among other state regulators and more professional sports leagues in a growing groundswell of opposition.

To paraphrase the Mandalorian: “This is the way…”